MONETA MARKETS CONS

- Limited number of markets to trade

- Regulatory licensing could be stronger

The post Trade 360 appeared first on Wiki Forex Reviews.

]]>

| Pros | Cons |

|---|---|

| Hundreds of trading instruments | Product range excludes cryptocurrencies |

| Multi-lingual customer support | Spreads are high |

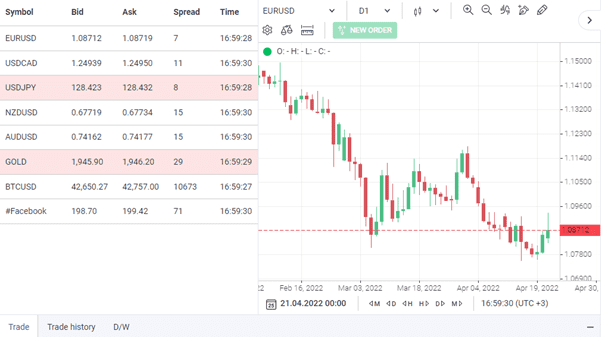

Trade360 is a CySec-registered forex CFD broker headquartered in Limassol, Cyprus. The tier-1 European regulation allows Trade360 to operate in all the countries within the European Economic Area (EEA), the UK and beyond. What sets Trade360 apart from most of the other CFD brokers is Crowdtrading, which gives a broad picture of the percentage-wise positions of the other traders.

Trade360 clients have the choice of five account types plus the swap-free Islamic account. The minimum deposits are reasonable and start at $250 for the basic account type, while individuals signing up for the VIP account have to deposit a minimum of $50,000.

The registration process is speedy, and you can start trading with deposits as low as $25. All client funds are in segregated accounts, separate from the CFD broker’s operating capital, and backed by investor protection schemes in certain countries. Irrespective of the account type, Trade360 offers the fixed spread.

Individuals registering with the CFD broker have the choice of only the patented Crowdtrading platform. While the trading terminal comes as a web and mobile application, it does not support automated trading. The product range includes forex, commodities, CFDs in shares and stock indices. Besides, traders can also access three futures contracts in commodities and stock indices.

The trading margins vary and are primarily dependent on the client’s location and the monitoring authority in that country. For instance, if you are a European or UK resident, the max permissible leverage is 30:1 in FX. However, International clients receive higher leverage that can extend up to 400:1. Besides, clients outside the purview of the CySEC are also eligible for the various bonuses offered by the CFD broker from time to time.

When it comes to client support, Trader360 provides a 24/5 bi-lingual helpdesk, although the website is accessible in 11-languages. You can reach out to the broker via phone, email, live chat or by simply filling out a ‘Contact us’ form.

Trade360 is a multi-asset CFD broker, operating since 2013 and regulated by the Cyprus Securities and Exchange Commission (CySEC). While this should ensure the safety of client deposits, the monitoring agency also has stringent guidelines in place to safeguard client privacy and data security.

If you include the one of a kind crowd trading platform, low minimum deposits, and multiple trading instruments, clients registering with Trade360 could hold an edge when it comes to CFD trading.

It is said that innovation is change that adds value, and that innovation distinguishes a leader from a follower. If you are searching for an innovative leader in the brokerage community that deals in the forex and CFD space, then Trade360.com may interest you.

The firm is neither a traditional forex broker, nor is it a binary options broker. It does offer an intuitive online trading platform that utilizes a revolutionary approach to social trading, a process they have named “CrowdTrading”. The firm has offices in London and is in compliance with regulatory regimes across Europe.

Trade 360 is a trade name of MPF Global Markets Ltd, authorized and regulated by the CySEC with license number 202/13. The company is headquartered in Limassol, Cyprus.

Trade360 was founded in 2013 by a group of professionals in the industry that desired to have a service offering “Where Wisdom of the Crowd meets Trading”, a concept currently under study that purports that the use of statistical data analysis tools on crowd behavior can actually reveal insights of favorable trends at work in the market in real time, much more quickly than with current technical methods.

The methods employed by Trade360 are proprietary and leading edge, but finding an “edge” is what trading is all about in the first place. As a relatively new firm, Trade360 has also been authorized under the stricter set of CySEC regulations that followed the crisis in Cyprus, and, as such, their clients benefit from broader deposit protections and service transparency.

Registration is simple, and $25 gets you started. No downloads are necessary. Their proprietary platform is online with a mobile application, if desired. There are 119 asset choices, including currency pairs, indices, commodities, and stocks. You specify your asset choice and amount you wish to put at risk, and then you are off and running.

It is not evident if you have actually purchased an option, a futures contract, or CFD in the background, but there is an expiration period of 60 – 90 days. You can elect to close a position at any time before expiration.

The spread is deducted from your account at the outset, and there is the possibility of a margin call, depending on the amount of leverage selected. Leverage and spreads vary by asset choice. CrowdTrading tools reflect what is hot and worthy of a second look. The rest is up to you. Unfortunately, U.S. customers are not accepted at this time.

Why trade with Trade360.com? The firm lists these reasons:

If you are looking for Metatrader4, you will not find it at Trade360. Their intuitive trading platform is of their own making in order to provide their unique system of Crowd Trading tools and displays.

No downloads are necessary, since the system is entirely online, with a mobile application if you prefer to go in that direction. Open positions and assets that are worthy of a second look, depending on crowd shifting sentiment changes, are easily visible and can be modified with a single click. All data is also encrypted using the latest in 128-bit technology for security purposes.

The minimum deposit required is $100 and can be made using major credit or debit cards, ewallet services, banking wire transfers, or other popular payment methods. Withdrawal requests are handled quickly, as long the mandatory AML documentation is on file and current. The length of time may vary depending on your original deposit method, since the same service must be used in reverse.

Technical support personnel are trained to answer your questions quickly and get you familiar with Trade360’s unique product and service offering. In addition to their direct support, there are training ebooks for beginners, and once up and trading, there is market commentary and analysis, supplemented by trading ideas generated by the system.

The firm does not give investment advice, or account management services, but it does attempt to give you the best and most timely information possible for your personal decision-making process.

Trade360 is definitely an innovative entry in the forex and CFD arena, attempting to use the latest technology advances to benefit its clients. Regulatory compliance is assured, and the firm’s offering is broad in its asset choices and straightforward in its delivery of service. As this management team asserts on its website, “By enabling our Traders to examine the movements and behaviour of the collective in real time, we empower them to better recognise market trends.”

Finding an edge before the crowd does is the goal of every trader, and, for the first time, Trade360 appears to be a broker that is prepared to give you that edge in real time with its unique and proprietary service offering.

**Note: Trade360 does NOT allow Scalping

The post Trade 360 appeared first on Wiki Forex Reviews.

]]>The post VT Markets Reviews appeared first on Wiki Forex Reviews.

]]>

| Pros | Cons |

|---|---|

| Competitive spreads | Low commissions |

| Inadequate educational resources |

VT Markets is a forex and CFDs broker operating internationally in over 120 countries. The broker offers 40+ forex pairs and over 100 CFDs on stock, commodities, and market indices. This broker product offering is limited when compared to what most competitors offer.

Even so, users can access the majority of popular global stocks such as Facebook and Google and Market indices such as the S&P 500 and Nikkei225. Also available are top global commodities, including Gold, Silver, crude oil, and natural gas.

VT Markets qualifies as a low-cost broker offering highly competitive spreads and low commissions. The broker offers two types of accounts, namely the Standard STP Account and the Raw ECN Account. Both account types have a minimum deposit requirement of $200 and maximum leverage of 500:1. The Standard STP account offers competitive spreads with a typical spread of 1.3 pips for the EURUSD pair.

Spreads are lower for the Raw ECN account with the typical spread for the same pair being 0.7 pips. However, the Raw ECN account also attracts a small commission. VT Markets charges swap fees on positions left open overnight. The broker doesn’t charge any deposit and withdrawal fees.

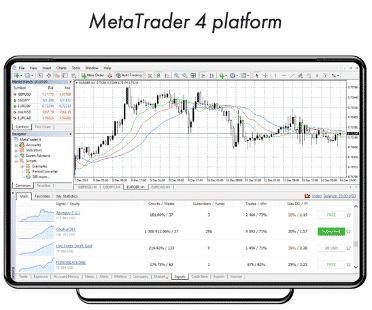

VT Markets only offers the MT4 trading platform. While this platform is what most traders prefer, it would be great if there was an alternative. Most of this broker’s competitors offer a proprietary trading platform. VT Markets also do not provide adequate educational resources, but this shouldn’t be a concern since there are a lot of high-quality free educational materials out there.

Overall, this broker seems like a good choice for any beginner and expert trader looking for a low-cost option to forex and CFDs trading.

VT Markets is a hybrid broker founded in 2016. The broker is based in Sydney Australia and operates internationally with presence in over 120 countries. VT Markets is a brand name of the Vantage International Group (VIG).

The broker product offering includes forex and 100+ CFDs in stock, market indices, and commodities. Its trading terms are highly competitive with floating spreads starting from as low as zero pips and zero commissions.

VT Markets leverage differs with the asset on trade with standard STP accounts enjoying of up to 500:1. Regarding trading costs, this broker charges a swap fee for positions left open overnight, during the weekend, or during public holidays.

Forex swap rates depend on market conditions and the interest rates of countries of the forex currency pair on trade. VT Markets doesn’t charge deposit and withdrawal fees. However, traders must verify if there is a transaction facilitation charge on the side of financial institution facilitating the transaction.

VT Markets is regulated by the Australian Securities and Investment Commission (ASIC) and the Cayman Islands Monetary Authority (CIMA). This broker offers a $200 well come bonus on new trading accounts with a deposit of at least $500. New accounts with a deposit of less than $500 enjoy a bonus of $50.

VT Markets appeals to anyone looking to diversify their portfolios through forex and CFDs. The broker provides 40+ forex pairs and 100+ CFDs in stock, market indices, currencies, and commodities.

Most of VT markets competitors offer 300+ CFDs, and hence this broker may not appeal to those looking for a wide variety of assets. However, nearly all the major global offerings in stock, market indices, and commodities are available. This broker doesn’t offer any crypto CFDs and is hence not suitable for those looking for crypto exposure.

VT markets also seem fit for beginner and expert traders since it offers the MT4 trading platform. This platform is beginner friendly and comes with advanced features to support expert level trading. Moreover, VT Markets is suitable for social copy trading, given that it supports a wide variety of third party signal providers.

VT Markets also supports money managers through its Multi Account Manager (MAM) solutions. The MAAM solutions can be customized to meet any wealth manager’s needs. VT Markets has partnered with MetaFX to create a superior MAM/PAMM console. The administrative side of the console is taken care of by the broker leaving wealth managers to focus on trade management.

VT Markets offers two types of trading accounts, namely the Standard STP Account and the Raw ECN Account. The Standard STP account is the most basic and offers superfast execution speeds of the bandwidth of up to 100 GB/S. This level of speed is perfect for swing traders and scalpers.

Moreover, those trading under this account type enjoy direct access to institutional grade spreads and dark pool liquidity for enhanced liquidity. VT Markets Standard STP account offers tight floating spreads from as low as zero pips and zero commissions. The minimum deposit for the Standard STP Account is $200, and the maximum leverage is 500:1.

With the RAW ECN account, there is no markup on spreads, and they start from as low as zero pips. Traders are only required to pay a small commission of $6.00 per standard lot, per round. The execution speeds for this account type are also superfast and hence suitable for fast-paced trading.

You need at least $200 to trade with the RAW ECN account. Moreover, the maximum leverage is the same as the Standard STP account.

VT Markets is an international broker operating in over 120 countries. As stated in the introduction, this broker is headquartered in Sydney, Australia. Moreover, it has offices in the Cayman Islands and Taiwan.

As mentioned earlier, VT Markets is regulated in Australia by the Australia Securities and Investment Commission (ASIC) and the Cayman Islands Monetary Authority (CIMA). ASIC is a tier-one broker respected across the globe.

VT Markets website and customer services are available in 9 languages, including English, French, German, Spanish, Portuguese, Vietnamese, Chinese, Spanish and Arabic. This broker is not available in the US, North Korea, Canada, Russia, CAR, Egypt, Yemen, Lebanon, Belarus, Libya, Mali, Tunisia, Zimbabwe, Republic of Guinea, and a few others.

VT Market products offerings include global stocks, commodities, and market indices. As we will see below, this broker provides top global stocks such as Facebook, Netflix, and Amazon.

VT Markets offers forex and CFDs trading. The broker provides 40+ FX pairs including majors, minors and a few exotics. VT Markets relies on its dark liquidity pool to offer tight FX spreads starting from as low as zero pips.

The typical spread for the EUR/USD pair for the Standard STP account was 1.3 pips at the time of publishing this review. Furthermore, the typical spread for the same pair with the RAW ECN account was 0.7 pips. This is highly competitive when compared to what competitors offer.

VT Markets offers over 100 CFDs in stock, forex, market indices, energies, precious metals, and soft commodities. Market indices include over ten global offerings including US2000, TW50, Nikkei225, S&P500, SPI200, DJ30, DAX30, CHINA50 and a few more. The maximum leverage to trading CFDs on market indices through this broker is 200:1.

VT Markets Energy CFDs offerings include Crude Oil, Natural Gas, Gasoline, UKOUSD, USOUSD, and Gasoil. The maximum leverage for crude oil is 500:1, Natural Gas 20:1, Gasoil 100:1, and USOUSD and UKOUSD 500:1. The spreads and commissions differ with the type of asset being traded.

Precious metals include gold and Silver offered at a leverage of 500:1. The typical spread for the XAUUSD with VT markets is 36.09 while that of XAGUSD is 27.97. Soft commodities offered by this broker include cocoa, coffee, cotton, sugar, and orange juice.

VT Markets share CFDs includes USD shares such as Google, Netflix, Amazon, and Facebook, and Hong Kong Shares such as Tencent, CCB, HANG SENG, CITIC, and many others. The commissions for share CFDs trading starts from as low as $6 per trade, and the maximum leverage is 20:1.

VT Markets fees and commissions depend on the type of account. The Standard ECN account doesn’t charge a commission but instead makes money through a markup on spreads. There are no spreads markups on the Raw ECN account, but commissions apply.

As mentioned earlier, VT Markets charges swap fees on positions left open overnight, during the weekend, or on public holidays. The swap charges depend on market conditions as well as the interest rates of the countries affiliated to the chosen currency pair.

This means that each FX currency pair has its forex swap charge. There is scanty information relating to VT Markets CFDs swap charges. Regarding non-trading fees, this broker doesn’t charge any deposit fees for most methods. However, deposits through China Union Pay attract a 1.30% to 2.50% fees.

Some deposit methods such as bank transfer and Neteller may incur fees on the side of the financial institution processing the transaction. Withdrawals through most methods are also free, but intermediary transfer fees may apply. This broker hasn’t disclosed if they charge any inactivity fees.

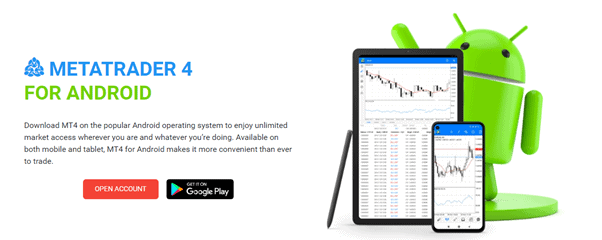

Like most competitors, VT Markets offers the MT4 trading platform. This trading platform is offered by about 90% of the brokers across the globe. Most offer it alongside a proprietary trading platform.

VT Markets doesn’t offer any proprietary platform, but this shouldn’t be a problem given that it provides multiple add-ons to enhance user experience. Traders with a deposit of at least $1000 enjoy a variety of MT4 plugins provided by Trading Central, a renowned third-party trading tools provider.

It’s worth noting that the MT4 trading platform is available in multiple versions, including web, desktop, and mobile. The web version is compatible with any browser, including Chrome, Mozilla, Safari, Opera, and Lynx. VT Markets MT4 desktop version is compatible with most operating systems, including Mac, Windows, and Linux.

The MT4 offers a wide range of trading research tools including 30 built-in indicators, 2000+ free custom indicators and 700 paid ones, 24 analytical objects, nine timeframes, and many more. Moreover, the platform is easily customizable to meet individual traders’ trade.

It also offers the ability to create Expert Advisors (EAs) for algorithmic trading through the MQL4/MQL5 wizard.

The MT4 is available in mobile versions compatible with iOS and Android devices. You can download it for free straight from Google Play or App Store and link it to VT markets.

You can easily register for demo trading through the MT4 mobile app. However, you need to register on the VT Markets website first to access live trading through the mobile app. As we will see later in this review, the registration process is simple.

VT Markets mobile app comes with all features found in the web and desktop versions to allow users to trade from anywhere. You can do all the trading straight from your mobile phone, iPad, and tablets.

The MT4 supports copy trading through its 3200+ free and commercial signals. Traders can tap into the trading wisdom of expert traders by copying their trades.

Moreover, expert traders can make extra money by sharing their trades. The signals can be found on the signals tab of the MT4 trading platform. Furthermore, traders can easily identify high-quality signal provides since they are ranked according to their performance.

VT Markets may not be a good choice for social copy trading since it only offers the bare minimum. Most of its competitors offer alternative and additional social and copy trading tools such as Myfxbook, Mirror Trader, and DupliTrade.

VT Markets offers the default MT4 comprehensive charting package. The charts are easily customizable to meet traders’ needs.

As mentioned earlier, the MT4 technical analysis tools include a wide range of free and paid indicators to allow traders to analyze the market of any complexity.

The 24 MT4 analytical objects include lines, Gann and Fibonacci tools, channels, shapes and arrows. These tools help traders to forecast future price dynamics, and they can be manually applied to indicator windows and charts.

The MT4 also provides fundamental analysis tools including an economic calendar and a regularly updated news portal.

VT Markets only provides a daily market analysis page under its trading education section. The analysis offers market insights and forecast on different assets. We find the posts to be comprehensive and helpful to both beginner and expert traders.

Unlike most competitors, this broker does not provide trading guides or courses. There are also no webinars to update users on the latest market developments. This broker does offer an FAQ page, but it is not up to date.

Even so, the lack of educational resources shouldn’t you from trading with this broker. There are a lot of free and paid high-quality trading courses of all levels on the web.

VT Markets is regulated in Australia by the Australian Securities and Investment Commission (ASIC) under license number 428901. It is also authorized and regulated in the Cayman Islands by the Cayman Islands Monetary Authority (CIMA) under Securities Investment Business Law (SIBL) number 1383491.

Both ASIC and CIMA observe strict deposit protection measures such as deposit segregation. For the record, deposit segregation refers to the separation of the broker’s operating costs with clients funds.

This prevents them from using clients’ capita for any other purpose other than the intended one. VT Markets segregates its clients’ deposits through AA rated National Australia Bank (NAB). Brokers must have at least AUD 1 million to apply for the ASIC license. This is enough evidence that all brokers under their regulation are financially stable.

VT Markets is compliant to data privacy measures in Australia and other jurisdictions, including the EU. This broker is compliant to privacy measures instituted by the EU General Data Protection Regulation (GDPR).

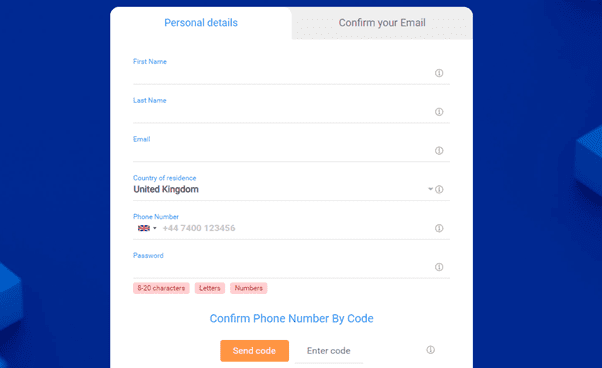

Registering a trading account with VT Markets is quite easy. Visit their website and select the live or demo account options. Fill the registration form as instructed and proceed by clicking the “Next” button.

You can also signup through your Facebook or Google Account. VT Markets platforms are encrypted to protect your data from online theft. Choose your preferred account type, the currency of trade, leverage, and the amount you would wish to deposit.

VT Markets require all users to verify identity. This is a mandatory KYC requirement among all well-regulated financial institutions. The process is meant to detect and prevent financial crimes such as money laundering.

You need to deposit at least $200 to trade with VT markets. The broker accepts account funding through debit/credit cards, bank transfer, Neteller, and Skrill. You can open a VT Markets demo account on their website or through the MT4 mobile app.

The VT Markets broker offer 24/5 multilingual customer support in English, French, German, Chinese, and Arabic. You can contact them through the live chat feature on their website, email, or phone call. It takes a few minutes to connect to their agents through phone and live chat. You can also request a callback, but you will have to wait for several hours to be called.

Emails, on the other hand, can take up to 24 hours to get a reply. VT Markets is also reachable on social media platforms, including Facebook, Twitter, and LinkedIn. A background check on VT Markets customer care agents reveals that they are friendly and knowledgeable.

VT Markets customer services are integrated to ensure that clients get all help in one phone call, chat or email. This broker has physical offices in Level 35, 31 Market St, Sydney NSW 2000 Australia and Artemis House, 67 Fort St, Grand Cayman.

VT Markets is legit forex and CFDs broker founded in 2016 in the Caymans Islands. The broker offers 40+ FX pairs and 100+ CFDs on stock, market indices, and commodities.

VT Markets is authorized and regulated in Australia through ASIC and Caymans Islands through CIMA. The broker offers two types of trading accounts, namely the Standard STP Account and the Raw ECN Account.

You need at least $200 to trade with either of the two accounts. Moreover, the maximum leverage for both types of accounts is 1:500. VT Markets is a low-cost broker charging highly competitive spreads starting from as low as zero pips. The Raw ECN account offers the lowest spreads and commissions.

VT Markets charges rollover fees on positions left open overnight, during the weekends and on public holidays. This broker does not charge any deposit and withdrawal fees on most methods. VT Markets offers the MT4 trading platform only.

How can I open a demo account on VT Markets?

It takes a few minutes to register a demo on VT Markets. Visit their website and fill the provided form to register a demo account. You can also signup for demo on the mobile MT4 by selecting the broker on the add broker tab.

Is VT Markets a regulated broker?

Yes! VT Markets is regulated in Australia through ASIC and in the Caymans Islands through CIMA. ASIC is one of the world’s most trusted regulatory authorities.

What bonus does VT Markets offer?

VT Markets offers a welcome bonus of $200 for new accounts with a deposit of $1000+ and $50 for accounts with a deposit less than that.

How do I withdraw money from VT Markets?

Fill the withdrawal form on VT Markets fund management page and wait for up to 5 business days for the funds to reflect in your bank account.

The post VT Markets Reviews appeared first on Wiki Forex Reviews.

]]>The post Moneta Markets Reviews appeared first on Wiki Forex Reviews.

]]>

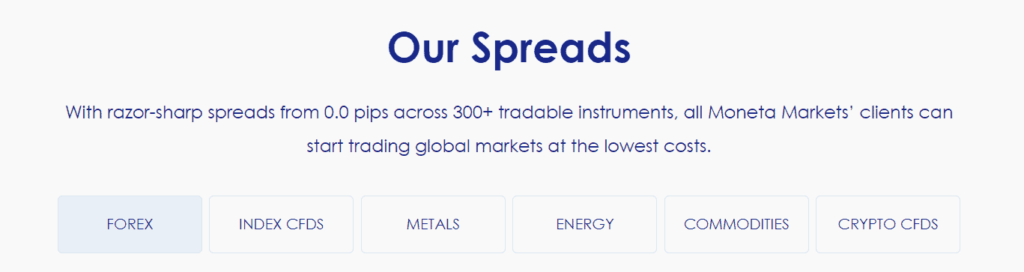

Moneta Markets is a CFD broker founded in 2020 on Caymans Island. It is a Vantage International Group (VIG) subsidiary, a forex broker popular with institutional traders. VIG Group serves over 70,000 traders and has monthly trading volumes exceeding more than $100bn.

The 300+ markets available use floating spreads which means trading costs can be super-low, mainly when market trading volumes are high. Leverage terms extend to an impressive 1:500, and the minimum account opening balance is $50.

Traders can fund their accounts through debit/credit cards, wire transfers, PayPal, Neteller, Skrill, FasaPay or Bitcoin. Moneta Markets does not charge any deposit or withdrawal fees. However, it is worth checking the T&Cs of third-party providers who might apply their charges.

Moneta Markets is regulated by the Cayman Islands Monetary Authority (CIMA) under Securities Investment Business Law (SIBL) number 1383491. Its parent company is regulated in the UK through the Financial Conduct Authority (FCA) and the Australian Securities and Investment Commission (ASIC).

This broker provides 24/5 customer service through email, phone, and live chat. Telephone and live chats are answered immediately, while emails can take up to 24 hours. In CV Magazine’s Corporate Excellence Award, Moneta Markets has won the Best Customer Support 2020 award in the CFD broker category.

Moneta Markets is recommended for both beginner and experienced traders. Its trading platforms are entirely beginner-friendly but behind the neat functionality are an array of powerful software tools. The broker offers adequate educational resources for both beginner and experienced traders.

The number of markets is not extensive, but the range of asset classes is impressive, and crypto trading is also supported. The Direct account is set up in a format ideal for beginners and the Prime account would appeal to scalpers and traders using the Expert Advisors service.

The Protrader platform Moneta Markets offers will be a real draw for some traders. It provides an extensive range of CFD trading research tools and a wide range of educational resources. Moreover, it has a user-friendly interface, and clients can manage all aspects of their accounts in one place.

The minimum deposit required to open a Direct account with Moneta Markets is $50. The service is not available to those based in the US, Canada, Belgium, France, Russia, North Korea, Lebanon, Tunisia or Yemen, and several other countries. Moneta Markets should be available in your country if you can access the signup page.

The free to use Demo account is an excellent way for new clients to find out what Moneta Markets has to offer or develop new strategies. The live accounts come in two forms. The Direct account uses STP processing and has a minimum balance requirement of $50, and the Prime account uses ECN protocols and has a minimum balance requirement of $200.

Compared to MT4, the Moneta Markets web-trader seems more intuitive and comprehensive. Both beginner and advanced traders enjoy the same trading features and educational resources. However, only traders with a deposit of at least $500 can enjoy the Moneta Markets master video course. The course includes 100+ advanced video trading tutorials.

The Moneta Markets demo account is a complete simulation of the live account. Consequently, traders can fully prepare without risking real money. The demo runs on real market data and offers an accurate picture of what to expect in live trading.

Moneta Markets assigns all new traders a dedicated account manager to walk with them through the critical first steps of trading. Shariah-compliant Islamic Trading accounts are available on both the Direct and Prime accounts.

Moneta Markets was founded to cater to retail CFD traders exclusively. The broker offers over 300 CFDs in forex, crypto, stock, market indices and commodities. The broker provides 45+ FX pairs, including all the majors, most minors, and several exotics.

Traders looking for exposure to major global stocks such as Apple Inc, Facebook and Google and market indices such as the S&P 500 and Dax 30 can trade with this broker. Commodity CFDs include gold, silver, US oil, sugar, corn, wheat, etc.

On the other hand, Crypto offerings include all significant coins, including BTC, ETH, BCH and XRP, paired against each other and fiat currencies. As mentioned earlier, Moneta Markets is not available in the US, Canada, Belgium, France, Australia, and several other countries.

Moreover, the broker is only regulated in the Cayman Islands, however, it enjoys global trust given the reputation of its mother company. VIG is regulated in the UK through the Financial Conduct Authority (FCA) and Australia through the Australian Securities and Investment Commission (ASIC).

A dedicated section of the Moneta Markets site gives an impressively transparent breakdown of the spreads in each market. A clear breakdown of T&Cs can help with the cost-benefit analysis of strategies and indicates that a broker is confident about their rates being better than average.

Spreads tend to widen during uncertain times, such as when important news is about to be announced. The spread for the EUR/USD pair as of the 26th May 2022 is 1pip. This is within the industry average. Also, the spread for trading BTC CFDs is $50. This is also within the industry average.

The commission mainly applies to share CFD trading and starts as low as 0.1%. Moneta Markets offers over 185 UK, US, Hong Kong and European share CFDs. This broker does charge a swap fee for positions left open overnight.

Moneta Markets claims not to charge any deposit or withdrawal fees. However, a small fee may apply on the side of the banks facilitating the transaction. This is expected with most brokers. All Moneta Markets trading education materials are free.

Moneta Markets offers the Protrader platform and access to MetaTrader’s MT4 and MT5.

The Protrader platform is highly intuitive and available in web and mobile versions. It also comes with over 45 built-in technical indicators, six chart types, trend lines and multiple drawing tools.

MT4 has less than 40 built-in technical indicators and three chart types. Another important feature available in the Protrader platform is an AI-powered Market Buzz. This feature allows traders to filter through the market noise and identify news with the highest impact on the markets.

The Protrader trading platform also offers a trading calculator to help traders determine key price levels and manage their funds efficiently.

Moneta Markets offers both the Take Profit and Stop Loss features regarding risk management. Moneta Markets also provide a Trailing Stop, a part that automatically notches up the Stop Loss as the markets move into profits.

There are video tutorials to guide users through the whole risk management process and how to use these tools efficiently. The Moneta Markets trading platform is intuitive and easily customisable to meet traders’ needs.

Unlike most of its competitors, this broker does not offer a desktop app. However, its web trader is compatible with most browsers. Consequently, users do not need a desktop trader.

As mentioned above, Moneta Markets offers both web-trader and App- based mobile trading platforms. Moneta Markets’ native mobile Apps work on Android and iOS devices and are available for free on Google Play and Play Store. MetaTrader 4 and 5 are also available in the App Stores.

They are lightweight and do not affect the device’s performance they are installed. Moreover, they come with all the features of the web trader, so users can manage their accounts while on the go.

You can easily signup for live or demo trading on the mobile app. It is, therefore, possible to exclusively trade or practice trading on your smartphone. The Moneta Markets mobile apps are highly intuitive and surprisingly easy to use, even for the complete beginner.

The MetaTrader platforms allow clients to tap into the trading ideas of others using the Expert Advisors tool. There is also a vibrant community of traders willing to share ideas and thoughts on the market.

The DupliTrade copy trading service offers another way of using the trading signals of other traders on your account. Choose the traders you want to follow based on your preferred instruments, trading method, and trading style. Their trades will automatically be duplicated in your Moneta Markets MT4 and Protrader platforms.

As mentioned previously, Moneta Markets provides CFDs on six of the largest cryptos by market capitalisation. These include Bitcoin, Ethereum, Ripple, Dash, Bitcoin Cash, and Tether paired against the USD.

The typical leverage for trading Crypto CFDs through this broker is 1:2. Most brokers offer about the same level of leverage. Moneta Markets’ spreads on crypto CFDs are floating, with the average spread for BTCUSD being $50.

Crypto trading is not made available to clients of all countries to comply with regulatory conditions.

Moneta Markets trading tools include over 45 technical indicators, 9-time frames, and six chart types. Also available is a suite of chart drawing tools, including trend lines and Fibonacci levels.

The Moneta Markets charting tools include an Indicator Wizard that enables traders to add any of the supported indicators in a few clicks. Also available is a trading calculator to help traders determine their trading specifics before going live.

With a trading calculator, traders can estimate their trade’s profits and losses, compare results from different opening and closing rates, calculate the required margin for their positions, and identify their pip value.

Moneta Markets trading resource centre includes trading guides and video tutorials, ranging from beginner to expert level trading education.

The video tutorials come in packages, with the most comprehensive one being Market Masters, which is only available to traders with a deposit of more than $500. Traders who qualify for this package enjoy over 100 video tutorials covering technical analysis, candlestick patterns, sharing CFDs day trading strategies, and more.

Free trading courses are also available to all registered users. They are well structured to cater for beginner, intermediate and experienced traders. All new traders are assigned a dedicated account manager to walk them through the learning and trading process.

There is also a free demo that back tests historical market data. With the demo, traders can practise their skills without risking real money.

Another neat feature designed to support clients make the most out of trading is Moneta TV. The channel provides market updates and daily economic insights into trading ideas based on fundamental and technical analysis.

Moneta Markets is monitored by the Cayman Islands Monetary Authority (CIMA) under license number 1383491. Tier-one regulators monitor its parent company in three jurisdictions, including the UK FCA.

Consequently, Moneta Markets is globally trusted even though not as stringently regulated as most of its competitors.

Moneta Markets segregates clients’ deposits through the National Bank of Australia. This is a globally recognised financial institution with stringent requirements for financial institutions accepting deposits from the public.

Registering a trading account with Moneta Markets is quite straightforward. Traders can register on their website or through the mobile app. Moreover, they have an option to register for a live account or a demo account.

For the live account, identity verification and proof of address are mandatory. The process involves uploading scanned copies of a government-issued ID card and a recent utility bill or bank statement clearly showing the current address.

Identity verification is nowadays a mandatory measure for all well-regulated brokers. Its purpose is to thwart financial crime, including money laundering. Moneta Markets handles user data in strict confidentiality as the EU General Data Protection Regulation requires.

Registering a demo account is simple and doesn’t require any verification. You can register on their website or straight from their trading app.

Like most brokers, Moneta Markets offers multilingual 24/7 customer service. They are reachable through email, phone, and live chat. However, emails can take up to 24 hours and are not the best choice for urgent communications.

We have tested their live chat and phone and can confirm that it takes less than a minute to connect. Their agents seem knowledgeable and well-equipped to handle all types of inquiries. Moneta Markets is also active on Facebook and Twitter. Clients can contact them through social media platforms.

Also, there is a comprehensive, well-presented, and regularly updated FAQ page to answer the most common questions. Moneta Markets recently received the 2020 Best Customer Service award in the CFD broker category by CV Magazines Corporate Excellence Awards.

Moneta Markets is a new broker positioned to offer CFD trading for retail traders. It is a subsidiary of VantageFX, another top broker offering spot forex trading primarily to institutional investors. VantageFX serves over 70,000 traders and facilitates monthly trades worth over $100 bn.

Moneta Markets is picking up pace fast thanks to its low-cost trading approach and superior trading platforms. It offers ECN and STP trading, and spreads start from 0 Pips and commissions from as low as 0.1%.

A few areas of the offering are relatively weak compared to established brokers. The number of markets is satisfactory rather than excellent, but as a new entrant, it can be expected that progress will be made in those areas. That doesn’t mean signing up to Moneta Markets now is not a good idea. The choice of high-quality platforms is as impressive as any in the markets, and trade execution is fast, cost-effective, and reliable.

It takes minutes to open an account with Moneta Markets, and the process is designed to be as user-friendly as possible. From one trading account, it is possible to trade a variety of markets and use whichever of the three platforms you find the best fit for your trading style.

Moneta Markets is a trademark of Vantage Global Limited. Vantage is regulated and authorised by the Vanuatu Financial Services Commission (VFSC), Reg No. 700271.

Moneta Markets doesn’t charge fees on cash deposits and withdrawals. There are some trading commissions to factor in, but these are competitive and in line with the industry standard.

The minimum initial deposit requirement for a Moneta Markets Direct account is $50. For the Prime account, the minimum balance requirement is $200.

The post Moneta Markets Reviews appeared first on Wiki Forex Reviews.

]]>The post Vantage Markets Reviews appeared first on Wiki Forex Reviews.

]]>

| Pros | Cons |

|---|---|

| Regulated by ASIC | No localised support for traders from Southeast Asia |

| Binary trading options | No regulatory control in multiple jurisdictions |

| Support for social trading |

Vantage is a well-established and oft-awarded Australian FX/CFD broker, that used to feature binary options in addition to its “more traditional” trading products, some time ago.

With the binary option part of the deal now gone, the brokerage has taken on an entirely different, much more serious appearance, and indeed, its reputation has taken a turn for the better as well.

That is not to say however that this reputation is currently spotless…There are quite a few negative reviews posted by users at various review portals, mainly decrying the usual issues: problems with withdrawals and alleged price-manipulation, with the goal of abusively triggering stop losses.

Obviously, there’s very little solid proof delivered with any of these complaints, but their mere existence is enough to raise a red flag with some.

In addition to those issues, the broker was apparently involved in a couple of less-than-savory incidents in the past, none of which carry much significance for the rank-and-file user though.

One such incident saw the broker deny payment to one of its IBs. After the latter complained about it online, the broker allegedly offered to make the payment if he removed the said complaint – thus effectively holding his money hostage.

Another problem pointed out by various reviewers was about a well-known scammer working as a Vantage IB for quite some time.

The bottom line reputation-wise is that – everything accounted for, and despite the above detailed issues – the user-feedback Vantage has managed to rack up over the years is overwhelmingly positive. There are scores more people who appreciate the services of the broker (and we know that content clients are much less likely to leave any kind of feedback) than complainers.

Trader monies are for instance kept in segregated accounts with the National Australia Bank, and the operation is a member of the KPMG – a global network of auditing firms – meaning that to ensure continued regulatory compliance, it undergoes regular 3rd party audits.

The Vantage website claims that the broker deals with an impressive list of liquidity providers, including Goldman Sachs, Bank of America and RBS – among others.

Founded in 2009, Vantage is indeed a major brokerage agency based in Australia, operating in one of the most stringent regulatory jurisdictions and prosperous.

The maximum leverage offered by the broker is 1: 500 – this is really impressive

The broker does not charge a commission for servicing the account, spreads start from 0 points (only on certain types of accounts), and the minimum required deposit is only $ 200, which makes the broker’s services accessible to everyone who is interested in trading.

Why did we call the Vantage reputation “spotty” in the name? Despite the fact that most of the reviews/reviews that brokers use on different portals are positive, there are always some who do not agree. Obviously – apart from the usual range of complaints about withdrawals and a bargain – the broker was involved in a number of allegedly behind-the-scenes actions at certain points in his existence.

In one such incident, payment to one of its IB (Introducing Brokers) was denied. After the said branch posted a complaint about the operator on one of the review portals, Vantage allegedly offered to pay him only if he first deleted the complaint. Whether such stories are true is currently completely impossible to verify. Their simple existence and implied trust raise a few red flags.

Another such problem was that Vantage allowed the famous fraudster to act as an IB for the operation for some time, although he was warned about this.

The corporate entity behind the Vantage brand is Vantage Pty Ltd. The company is registered in Australia; its registration number is ACN 140 903 886. However, this company is not a direct issuer of the services presented on the Vantage website. This honour belongs to Vantage Global Prime Pty Ltd, also a registered Australian company, whose official representative is Vantage Pty Ltd.

Liquidity brokerage partners are some truly high-profile legal entities in their own right. We are talking about those such as Citibank, JP Morgan and HSBC.

Why do you want to trade with this undoubtedly serious online FX / CFD provider?

Unlike most other regulated brokers, Vantage offers a cash bonus, as well as access to real ECN execution. With spreads starting at 0 pips, there is no need to sneeze on the trading conditions either.

Thanks to MT4, as well as MT5, the broker offers its users access to some of the best existing solutions for online trading.

Trading conditions always come first as far as value is concerned, and Vantage have quite a solid thing going in this regard.

On some of their (ECN) account types, their spreads start from 0 pips (such accounts do charge a commission though).

In addition to that, the site delivers a few other reasons why one should trade there, in a special section.

Transparency and strong regulation are both on that list, together with the generous, 1:500 leverage that’s also offered. The broker is an award-winning one – as mentioned in the beginning of this review – and it features a superb range of trading platforms.

Its execution speeds are said to be superb as well as is its market coverage (it includes several cryptocurrencies in addition to the regular lineup of tradable assets).

Opening an account is supposedly easy as well though that probably only goes for Demo accounts, since for real money ones, there are quite a few questions asked and documents required.

Vantage currently supports three types of accounts, of which the most accessible is the standard STP account, which obviously supports STP execution.

This type of account offers access to the entire spectrum of markets supported by the broker, and its minimum balance is $ 200.

Spreads at this start at 1.4 pips, and the maximum available leverage is 1: 500.

A standard STP account does not charge fees.

The next step up the account type ladder is the Raw ECN account, which is declared the most popular broker account option.

The execution on this account is ECN, and the minimum balance that is required is 1: 500.

Spreads start at 0 pips (as you would expect from such an account), but a commission of $ 3 is charged on each lot.

The Pro ECN account is an option of a “complete additional” broker. The minimum required balance on such an account is $ 20,000. Trading conditions are really the best at that. In addition to ECN execution, the Pro account has a range of 0 points and a commission of $ 2 per lot on each side.

The maximum available leverage is 1: 500 for this type of account.

In addition to the detailed account types listed above, the broker also offers Islamic account versions, as well as a demo account for those who want to test the platform (s).

The Vantage website shows a typical spread of 1.4 pips on EUR / USD on a Standard account. On Raw ECN accounts, the typical spread is 0.1 pips with a commission of $ 3 per way ($ 6 per full transaction).

As mentioned above, the size of spreads and accrued commission depends on the type of trading account that a trader uses. On STP trading accounts, the minimum spread starts at 1 pip. On ECN trading accounts, the minimum spread may be 0.0 points. But for each traded lot, traders are required to pay a commission of $ 3.00.

When it comes to trading platforms, the variety of Vantage offers is unparalleled. At least nine options are available, mainly with MT4 and MT5.

MT4 is the most popular trading platform in the world, perhaps the centrepiece of the Vantage offer. In addition to the Windows version, which can be downloaded for free from the Vantage official website, the platform is also available in the Mac version.

MT5 is obviously an upgrade from MT4, but still, it is slightly less popular than its successful predecessor. Those looking for better and easier ways to create personalised technical indicators and experts will certainly appreciate the improvements made by MT5.

Both platforms are available in mobile formats, so busy traders can continue to trade while on the move. Mobile versions retain most of the useful features and benefits of the full versions.

In addition to the above, the MT4 and MT5 versions are available in Web Trader versions for those who cannot or do not want to download anything to their local machines. The web trader versions are also amazingly capable and customizable.

However, MT4 and MT5 web traders are not the only browser-based trading options. Market Trader, developed by ChartIQ, is also available at a brokerage company. HTML5-based Market Trader is compatible with almost all browsers.

Options offered by the broker, MAM / PAMM accounts, are obviously intended for those who are looking for high-performance trading solutions. With this option, you can manage multiple accounts, which is very useful for experts trading for multiple clients.

The MyFxBook AutoTrade feature further enhances social trading opportunities. This allows users to copy trades of more successful and profitable traders.

ZuluTrade, another solution provider Vantage has teamed up with, is at the peak of its social trading experience.

Vantage provides customers with the opportunity for mobile devices. Trading applications are available for devices based on iOS and Android.

Since the Vantage broker is mainly focused on the use of MetaTrader, the mobile versions of the MT4 application for iOS and Android are quite standard and are available for installation from the Apple iTunes and Android Playstore stores, respectively.

Vantage works with Myfxbook AutoTrade, an automated trading service that allows customers to access social trading. Myfxbook AutoTrade is an automatic copying service for trading strategies that allows Vantage traders to access the trades of many successful traders.

Vantage does not have actual cryptocurrencies; however, the company provides CFD contracts for popular cryptocurrencies.

In addition to the basic platforms, for customers using the MT4 web version, Vantage also offers access to the innovative ChartIQ web platform (under the MarketTrader brand) as an alternative web platform that can be used with an MT4 account.

The site has a section on the education of future traders. Having carefully studied the information presented, the client will have the necessary basic terminology, as well as an understanding of how the web platforms presented on the site function, what factors affect the value of assets, etc.

It should also be added that Vantage has a demo account for beginners. This tool allows you to practice learning everything you need to trade online without spending a cent of your own savings on these goals. Fast, convenient, reliable, and most importantly – it is a very productive tool.

Reliability Vantage extends not only to the financial support of firms but also to the provision of services. Vantage uses only the proven MetaTrader 4 (MT4) platform. Thanks to the advanced functionality of the platform, MT4 Vantage can conclude transactions with lightning speed.

Complying with high standards of professionalism and ethical standards, Vantage has taken the protection of clients’ funds to a new level by means of insurance of funds. $ 20 million of coverage is provided by SJ Catlin and Lloyds of London.

The registration process on the Vantage website takes no more than 5 minutes. To create a trading account, the client needs to click on the Live account button at the top of the page and fill out the registration form. You must also specify personal and contact information, country of residence, as well as the type of account.

After completing this procedure, the client will be automatically transferred to another registration form on vantage.com. There, he will need, in addition to personal data, to indicate account parameters and passport data or ID-card data.

After completing the process of creating an account, it is recommended to go through verification of the account. As customers say in their reviews, this eliminates problems with the withdrawal of funds.

The handiest way to contact the support staff at Vantage is through the Live Chat feature, which can be launched from anywhere on their site.

Dropping an email to [email protected] is also always an option.

In addition to all the above, regional phone numbers are provided in the Contact section of the site, for China, Canada, UK and for international clients.

Vantage’s reputation may not be impeccable, but it is certainly good enough to interest any trader: beginner and professional.

The site offers excellent trading platforms, trading conditions, execution and market coverage.

Please note that some products and multiplier levels may not be available to traders from EEA countries due to legal restrictions.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

The post Vantage Markets Reviews appeared first on Wiki Forex Reviews.

]]>The post Adrofx Reviews appeared first on Wiki Forex Reviews.

]]>

AdroFX is a relative newcomer to the broker sector, but it has used that to its advantage by designing a platform that certainly meets traders’ needs. Established in 2018, the broker has not yet had time to develop a vast range of markets to trade, but it does offer the core markets with competitive terms and a few nice-to-have bonus features thrown in.

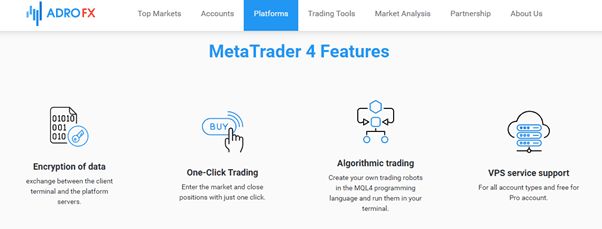

The trading experience is up there with the best on offer, thanks to AdroFX choosing to offer clients MetaTrader’s MT4 platform. MT4 remains the benchmark by which other platforms measure themselves, and the fact that it is the most popular retail FX platform in the world speaks for itself.

Most who have traded before will be familiar with MT4’s crisp aesthetic and surgically sharp charting tools. It’s also been tested to destruction thanks to the millions of users who have used it over the years. Also, there is a flourishing online community of MT4 users to consider. Crowdsourcing ideas or drawing on the thoughts of others is always helpful when trading.

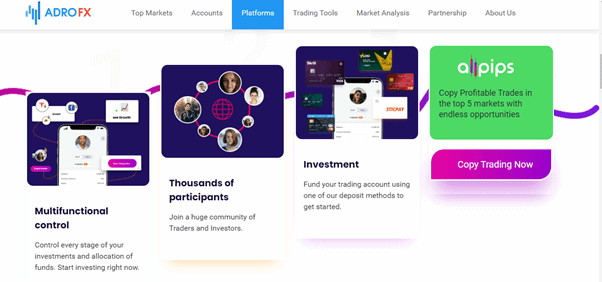

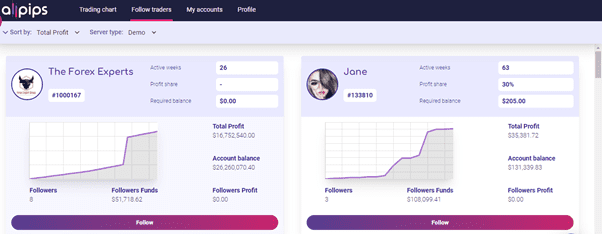

Three standout features of the AdroFX platform are the Allpips dashboard, the ability to fund accounts using crypto and the bonus features, which include a 100% Deposit Bonus.

Allpips is a neat addition to the MetaTrader suite of platforms and allows for Copy and Social trading, which is always attractive to beginners.

The other two features, the ability to fund using crypto and the presence of deposit bonuses, will divide opinion. There’s no getting around the increasing role that cryptos play, and everyone likes being given free money to trade with.

AdroFX has an international feel to it. It was founded in 2018 and provides its global client base with a wide range of trading products and services. The emphasis is on transparency and pushing the boundaries in terms of innovative technology and trading tools.

The management team comprises industry professionals with decades of experience in Financial Markets, the Banking Sector and Fintech. They adopted the best practices of the broker sector and made the most of technology upgrades to ensure their clients are provided with just what is needed to take their first steps into the market.

The customer-centric approach has resulted in the functionality of the AdroFX site and its trading platforms being designed to be user-friendly.

As with other new brokers, there are some areas in which the firm could develop and expand its operations, and it is making progress in terms of tech infrastructure, Copy Trading and T&Cs. The improvement is reflected by the growing client base and the fact that traders from more than 200 countries already use AdroFX to trade the markets.

AdroFX is regulated by two different financial authorities, with the protection allocated to each client depending on where they live. The regulators are recognized names, but some might not regard them as Tier-1 authorities. However, they offer clients a degree of protection if something does go wrong.

AdroFX will appeal to those who can look past the decision to gain regulatory licences from SVGFSA and VFSC, and there are, at face value, at least some benefits from doing so. The Deposit Bonus offers to new clients involves the broker backing up any deposits with additional funds; also, plenty of traders are looking to fund their trading using crypto.

The core trading platform is hard to fault, and the T&Cs in terms of spreads and inactivity fees are in line with the peer group. The 1:500 leverage rates on offer trump the 1:30 maximum offered by brokers regulated by Tier-1 authorities. That facility will undoubtedly appeal to some traders.

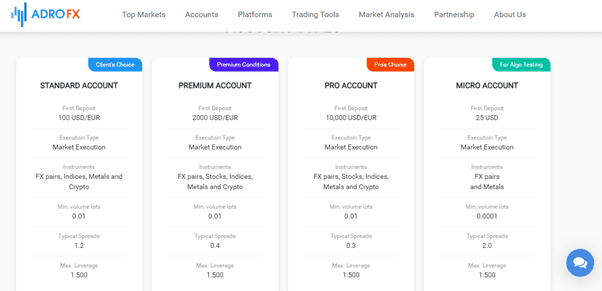

There are ten different accounts from which to choose. That might, at first sight, appear overwhelming, but four relate to the Allpips platform and six to MT4. They cater to a wide range of trading profiles, meaning beginner and Pro traders can find the best account for their needs.

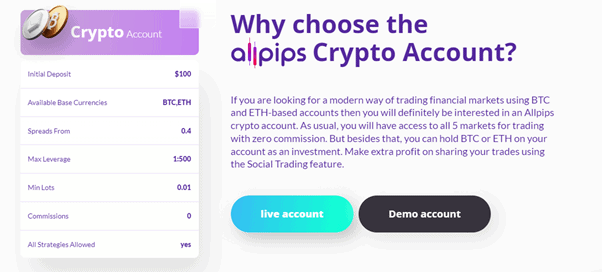

The Allpips Crypto account will catch the eye of crypto traders. It can be funded using Bitcoin or Ethereum and has a minimum account opening requirement of $100.

The Allpips Fiat account has similar functionality to the Allpips Crypto account, but it is just funded with fiat currency. The two remaining Allpips accounts are the Cent account with a minimum opening balance requirement of only $25 and the Allpips Demo account. Both accounts are ideal for those just starting in trading or considering using Copy and Social trading for the first time.

The three main accounts on the MetaTrader4 platform are Pro, Premium, and Standard, with the T&Cs associated with each varying according to the size of the deposit made. The Swap-Free account ticks the box for those looking to carry out Shariah-compliant trading, and the MT4 Micro and Demo accounts are that platform’s entry-level accounts that are ideal for those who are new to trading.

The company targets a global client base but does not currently accept clients from the USA, Germany, Japan, Canada, or New Zealand.

The fee schedules at AdroFX are refreshingly transparent. There are no additional commissions on trades, so the only costs to put on a position are included in the bid-offer spread. So, at face value, some of the spreads might appear to be slightly wider than the market average but makes calculating the cost-benefit of a strategy a lot more straightforward.

Operational costs are also limited in number and scale. There are no fees charged on deposits, and the inactivity fee of $5 only kicks in after six months of no trades being booked, so it should be manageable for most traders.

The ever-popular MT4 platform remains the ‘go-to’ option for millions of traders around the globe. Its intuitive functionality and neat aesthetics allow traders to focus on what is important.

Behind the user-friendly interface sits an impressive trade execution infrastructure and a host of powerful software features. It’s possible to set your AdroFX account up for VPS trading to ensure you’re trading in the heart of the market. The average trade execution time at AdroFX is quoted as an impressive 11.07milliseconds.

The AdroFX Trading Signals feature is a neat add-on. It’s been developed by AdroFX analysts and is designed to identify and report trading opportunities in real-time. Beginners often report that interpreting price moves and converting them into trade entry and exit points can be challenging, and the Trading Signals package is designed to help with that.

The Allpips platform is stand-alone and cloud-based, so it’s possible to manage your trading activity anywhere you can access an internet connection. It is the home to thousands of experienced traders who are willing to share their trading ideas, and it’s even possible to hook up your account to follow the lead of others and trade when they do.

The AdroFX functionality transfers well to the smaller screen of handheld devices. They can even be used to register accounts and process payments making the AdroFX Apps ideal for those looking to trade markets on the go.

The AdroFX functionality transfers well to the smaller screen of handheld devices. They can even be used to register accounts and process payments making the AdroFX Apps ideal for those looking to trade markets on the go.

The MT4 platform is compatible with Android and iOS devices and is available in WebTrader format, requiring little more than an internet connection for users to access their accounts.

AdroFX has done well to include Allpips among the range of platforms on offer. Allpips represents one of the latest moves by IT firms into the world of Copy and Social Trading and incorporates a lot of the tried and tested functionality of established platforms.

Those looking to Copy trade can carry out granular level analysis on the track record of traders they are considering using and then track their shortlist before signing up to use their signals on their account. The profit share that goes to leading traders is variable and can be relatively high for the most successful traders. We saw some profit share commissions as high as 30% during trading. The hope is obviously that by incentivizing the best traders to share their trades, the platform creates a win-win situation.

AdroFX is a broker that has set out to be crypto-friendly. Accounts can be funded by the likes of Bitcoin and Ether, and those instruments can also be traded. One feature which will appeal to crypto speculators is the ability to trade crypto in CFD form rather than only buying it outright. That opens the door to CFDs’ added functionality, which includes the ability to sell short and scale up on exposure by using leverage.

The charting package offered by MT4 is widely regarded as one of the best in the market. The graphics on the platform are razor sharp and can be set to three different colour settings, and there are nine different timeframe settings.

All AdroFX clients are set up with an impressive default package of 50+ trading indicators designed to be effective in trending, sideways, and breakout market conditions. Whilst that number of tools is sufficient for most, the neat functionality of the MT4 platform allows users to download different tools provided by third parties, many of which are free to use. It also has a user-friendly ‘trading robot’ to help clients take the first steps towards automating their trading decisions.

The educational package offered by AdroFX is in line with the sector average. Topics covered are ‘how to trade’ and what is a pip’, providing a sufficient grounding to new traders. The information can be accessed in video and e-book format for no charge.

Research, analysis and news resources are available. Blog updates are provided once a month. There is limited access to materials that might support those looking to carry out fundamental or technical analysis to identify their next trading opportunity.

Those looking for inspiration do have the option of heading to the MetaTrader platforms for ideas. The online MT4 community is well established and can provide strategy ideas suitable for novice and experienced traders. The Allpips service involves digging into the details of other people’s trading activity, so it can, in that sense, be considered educational.

AdroFX is comprised of two entities, ADROMKT Limited and Adro M Group LLC. Two different financial authorities regulate the two companies, and the details of cover will be determined by where a client is domiciled and which of the two firms they sign up with.

ADROMKT Limited, Company number 700546, is regulated and licensed by Vanuatu Financial Services Commission (VFSC) with its Registered Office at Govant Building, BP 1276, Port Vila, Vanuatu

Adro M Group LLC is incorporated in St. Vincent and the Grenadines, number 1061 LLC 2021, by the Registrar of International Business Companies and is registered by the (FSA) Financial Services Authority. Address First Floor, First St. Vincent Bank Ltd Building, James Street, Kingstown, St. Vincent and the Grenadines.

Both authorities are widely used by brokerage firms aiming to attract a global client base. Clients’ funds are segregated from the broker’s cash, and protocols are in place. The regulators, although not Tier-1, have a more accommodating approach toward leverage, bonuses and the use of crypto. That makes them a popular choice for brokers looking to attract traders that wish to run more aggressive trading strategies.

The registration process is designed to be super-easy. If users experience any issues whilst trying to sign up, the customer services team on Live Chat can quickly resolve them.

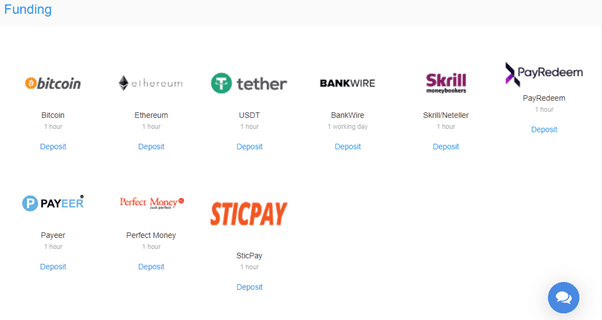

Once through to the platform, funding of accounts can be actioned using various payment methods. As well to crypto and bank wire transfer, it’s possible to use e-payment services, but credit and debit card transfers are not supported.

Customer support is provided around the clock and available via phone, Live Chat, and email. The 24/5 accessibility will appeal to beginners and more active traders as being able to speak to your broker at any time can make a real difference to your trading performance.

Another neat feature of AdroFX was that we received a courtesy call from one of their team after registering. This is to help new users who might have questions about how things work. It was preceded by an introductory email advising of contact being made so that it didn’t feel like a cold call.

AdroFX has, in a short period, established an appealing niche in the ultra-competitive broker sector. The core set-up uses tried and tested names such as MetaTrader MT4 and has T&Cs, which will allow its clients cost-effective access to the markets.

The platform has already proven popular with traders from more than 200 countries worldwide that are using the service. Some will be drawn to the regular trading services, 24/5 customer support, fast trade execution, and a modern Copy trading platform.

What helps the broker stand out and will appeal to many is the firm’s position on the risk-return spectrum. Its decision to set up with Tier-2 regulators has allowed it to offer clients leverage terms and bonus offers that other brokers can’t match. The weighting towards crypto, with coins being able to be used to fund accounts, will also appeal to fans of Bitcoin and Ether.

Finding a best-fit broker comes down to establishing what your trading aims are. AdroFX won’t be for everyone, but the comprehensive risk-on set-up will undoubtedly appeal to many.

It takes about five minutes to open a fully functional account. To open an account, you must visit the site and fill out all your details in the provided account registration form. Setting up a demo account to try out the service takes less than 20 seconds.

Yes, AdroFX is regulated in two different jurisdictions:

ADROMKT Limited, Company number 700546, is regulated and licensed by Vanuatu Financial Services Commission (VFSC) with its Registered Office at Govant Building, BP 1276, Port Vila, Vanuatu

Adro M Group LLC, which is incorporated in St. Vincent and the Grenadines, number 1061 LLC 2021 by the Registrar of International Business Companies, is registered by the (FSA) Financial Services Authority. Address First Floor, First St. Vincent Bank Ltd Building, James Street, Kingstown, St. Vincent and the Grenadines.

Both authorities are familiar brands among the trading community but aren’t regarded as Tier-1. However, they are more accommodating in terms of leverage terms, bonus offers, and the use of crypto.

The pricing schedule at AdroFX is clear and transparent. There is no separate commission on trades or cash deposits. There is a $5 inactivity fee which kicks in after six months, and the charges for overnight financing of CFD positions are in line with the rest of the peer group.

The post Adrofx Reviews appeared first on Wiki Forex Reviews.

]]>The post Squared Financial Reviews appeared first on Wiki Forex Reviews.

]]>

In a market that is increasingly populated by brand-new entrants, it can often be quite difficult to find a trading platform with a bit of experience behind it. This is not the case with Squared Financial, however, which is one of the few trading platforms with a team who have multiple decades of industry experience between them. Founded all the way back in 2016 – when the online trading and investment scene was a much different space – Squared Financial is headquartered in Cyprus and focuses primarily on the European market. However, company history aside, what does SquaredFinancial bring to the table that you won’t find on offer elsewhere, and how does it differentiate itself from the competition?

One of the most immediately obvious things that helps SquaredFinancial stand out from the competition is the trading conditions it offers. With Pro accounts giving traders access to spreads starting from 0.0 pips, and a low commission of $5 on each lot traded, these are some of the most favourable trading conditions around. Although the range of instruments supported is not quite as extensive as you might find elsewhere, these favourable trading conditions are hard to argue with. For novice and intermediate traders, in particular, SquaredFinancial is a really solid option, and the range of educational materials on offer makes it a great place to get started.

For this reason, if you are looking for an open and transparent broker that has lots of experience behind it and provides favourable trading conditions, SquaredFinancial is the perfect place to get started in the world of online trading and investment!

SquaredFinancial is an online trading and investment platform, founded in 2016 and currently headquartered in Cyprus. With a focus on giving retail traders access to the latest fintech trading technology, SquaredFinancial is a global investment gateway. The team at SquaredFinancial comprises experienced industry professionals with decades of experience in the financial services sector between them. Its focus is on providing retail traders with all the tools, professional support, and trading conditions and products necessary to enter into the financial markets and achieve financial freedom.

In terms of what SquaredFinancial looks to offer over its competitors, it prides itself on providing competitive trading opportunities, superior trading tools, multiple account types, fast execution speeds, cutting-edge trading technology, and free educational resources.

SquaredFinancial is suitable for traders of all skill and experience levels, though novice and intermediate traders will find the most value on the trading platform. Although the trading conditions on the Elite account are particularly favourable for day traders and professional clients, they may ultimately find the selection of assets available to trade quite limited. For this reason, the SquaredFinancial trading platform is best suited to a novice or intermediate trader looking to build up their investment portfolio. The educational materials on offer are also aimed at this demographic, which makes it an even better choice.

To suit the various types of traders who will be attracted to the platform, SquaredFinancial offers a number of different trading accounts. The two main trading accounts are separated in a ‘Squared Pro Account’ and a ‘Squared Elite Account’.

The Squared Pro Account is aimed at the average online trader and offers base currencies of EUR, USD, GBP and CHF. It is a commission-free account, though it will generally have higher spreads than the Elite account. As it is aimed at the average trader, the deposit minimums are much lower on the Pro account – these start from $0.

The Squared Elite Account, as you might have guessed, provides a trading experience that is more suited to professional traders and higher-volume day traders. Much like the Pro account, the base currencies are EUR, USD, GBP and CHF. Unlike the Pro account, the Elite account has a flat commission of $5 per lot. However, the flipside of this is that spreads start from 0.0 pips! As it is aimed at professional traders with higher daily volumes, the minimum first deposit amount is $5,000.

In addition to the Pro and Elite trading accounts, SquaredFinancial also provides an Islamic trading account. Also known as swap-free accounts, Islamic accounts benefit from exactly the same trading conditions and terms as the main trading account types. The main difference is that there will be no swap or rollover interest on overnight positions. Islamic accounts also benefit from higher leverage thresholds of up to 1:500.

As it is established in Cyprus, SquaredFinancial’s main focus is on servicing the European market. Although we were unable to find comprehensive information about the countries it supports clients from or where its services are restricted, the languages on offer indicate its geographic focus. The SquaredFinancial website currently offers support in English, Arabic, Spanish and Chinese, which appears to be where its focus is in terms of markets and territories. At the present moment, it does not appear that US citizens are supported by SquaredFinancial.

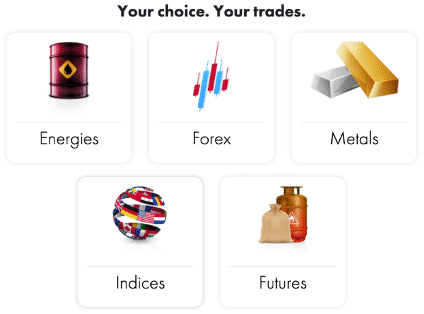

SquaredFinancial’s focus in terms of the instruments supported is on CFDs spread across energies, forex, metals, indices and futures. Of these, its focus is mainly on forex, though the other instrument types are also very well supported.

You can trade over 40 different currency pairs, though they mainly cover the minor and major currency pairs without too much support for exotic currencies. Energies include Brent crude oil, WTI oil, and natural gas. In total, SquaredFinancial provides support for over 70 trading instruments spread across five different asset classes.

Spreads are quite low on the Elite trading account type, starting from 0.0 pips. However, on the basic account type, they are significantly higher, starting from an average of 1.2 pips.

Traders using the SquaredFinancial platform can also benefit from leverage trading, which is capped at 1:30 for retail clients and 1:500 for professional clients.

The fees and commissions you get charged on a per charge basis will depend on what type of trading account you have set up with SquaredFinancial.

Currently, the broker provides access to two main trading accounts: Squared Pro and Squared Elite.

Squared Pro is aimed at the average trader who tends to trade a small to medium volume in a given trading period. It provides average spreads from 1.2 pips (on EUR/USD). While not necessarily the most competitive spread that we have seen, the Squared Pro account does benefit from commission-free trading, which makes it significantly more attractive. The Squared Elite trading account offers average spreads of 0.0 pips (EUR/USD), though it will charge a $5 commission on a per lot basis.

It is also important to note that SquaredFinancial does not charge any additional fees on, for example, withdrawals or deposits, and we were unable to find information on any additional fees or hidden charges. As such, the trading conditions offered by SquaredFinancial are very favourable.

Trading on the SquaredFinancial platform is done primarily through MetaTrader 4 (MT4). The MT4 platform is currently the market-leading forex trading platform and has garnered a whole raft of industry awards. It is the chosen trading platform for traders of all experience levels thanks to its easy-to-use layout, customisability and robust charting features.

MT4 is completely customisable and allows you to create custom layout and templates to suit your own trading style and strategies. Additionally, it also allows you to draw historical price charts for back testing and analysis purposes. It also provides full support for automated trading and social trading via the Myfxbook tool.

Given how well established the MT4 trading platform is, there is very little that we can realistically critique or review! The MT4 platform is the industry standard for a reason and it makes sense that SquaredFinancial would select it as its platform of choice. Going forward, however, it would be good to see some support for the newer MetaTrader 5 (MT5) trading platform.

For those of you looking to take your trading account on the go, you will be pleased to know that SquaredFinancial does provide support for mobile trading. This is done through the MT4 platform, which they give all users access to.

Although there is not a bespoke SquaredFinancial mobile trading app, the MT4 mobile app is more than up to the job. It is praised for its robustness and ease of use, and can be downloaded to iOS or Android devices. The MT4 mobile app gives you complete access to your trading account on the go and allows you to execute all MT4 order types.

Social trading and copy trading have become two of the most popular – and sought after – trading platform features in recent years. With so many new traders trying their hand at online trading for the first time in recent years, these tools have become a popular way for novice traders to learn tips, tricks and strategies straight from experienced traders.

In terms of how SquaredFinancial stacks up in this department, while not offering dedicated or bespoke social and copy trading tools, it does make a number of options available.