FUSION MARKETS PROS

Lowest Commissions in Australia

$4.50 per lot RT

| Fusion Markets Pros | Fusion Markets Cons |

|---|---|

| Low trading costs | Inadequate educational resources |

| Well regulated | Limited tradable assets |

| Both the MT4 and MT5 are available | Not available in the US |

| Excellent customer service | |

| No minimum deposit |

TRADERS’ VIEWPOINT

- Fusion Markets was set up in 2010, based in Melbourne, and is regulated by the Australian Securities and Investment Commission (ASIC). Fusion has over 100,000 users. It is a low-cost broker that operates in 60 countries offering Forex, including 90 currency pairs, and CFDs on stock, commodities, indices and Crypto, including 5 pairs that consist of Bitcoin, Ethereum, Dash and Ripple.

- Fusion Markets trading platform takes advantage of the well known and universally accepted MetaTrader MT4. This appeals to both beginner and experienced traders. The platform is available on web, desktop and mobile (Android, iOS and Windows) and is customisable. Fusion Markets has also sensibly partnered with third party tools providers, like DupliTrade, that enables a beginner to duplicate the actions of experienced traders and is a popular social-copy trading platform.

- The account opening process at Fusion Markets is relatively straightforward. The first stage being able to hook up to their demo account. The broker does not have a minimum deposit requirement for either of their two types of accounts, the Zero (for more experienced traders) and Classic (for beginners) Account. Fusion accepts deposits through Wire Transfer and all major debit and credit cards. The accepted currencies include USD, AUD, GBP, JPY and SGD.

- Fusion Markets offers comprehensive guides and structured online courses covering all types of trading. There are other educational materials available via video tutorials and manuals. Fusion Markets also partner with third party trading education providers to offer trading courses. Some courses may require a fee. There is a 24 hour, 5 day-a-week customs support service in English or Thai. The support team at Fusion Markets come across as very knowledgeable.

- Crypto trading has some interesting flexibility on the Fusion Markets portal. Crypto CFDs trading with the broker comes at zero commissions and no-requotes. Under Crypto CFDs, a trader has the option of a short sell strategy to speculate on both rising and falling prices. Fusion Markets do provide a leverage of up to 1:500, which is attractive relative to peers, but traders should approach with caution and an understanding of the risks.

- Commission and fees are relatively attractive when operating through Fusion Markets. A typical spread for the EUR/USD pair when trading through the entry level Classic account, is 0.9 pips and 0.5 pips for the Zero account. As mentioned, Fusion does not charge any deposit or account inactivity fees, which is also more attractive than its peers. Withdrawals within Australia are free whilst International withdrawals attract a low fee of AUD20.

ABOUT FUSION MARKETS

Fusion Markets is one of the younger and smaller players in the retail online broker industry. However, it has a good number of loyal clients and has a very attractive commission and fee structure for traders to utilise. The trading platform, being MetaTrader, is well known clear, transparent and agile. The educational and customer support is s good as some of its larger competitors. This is all backed by a strong regulatory and operational framework under the ASIC.

Fusion Markets is a low-cost broker offering forex and CFDs on stock, commodities, indices, and crypto. This broker operates in over 60 countries in Europe, Asia, and South Africa. Moreover, the broker has its headquarters in Australia and is regulated by the Australian Securities and Investment Commission (ASIC).

For the record, ASIC is one of the world most respected broker regulatory bodies. Fusion Markets is a brand name of Gleneagle Asset Management, a financial company that is registered in Australia and monitored by the ASIC under license number 226199.

Fusion Markets trading platforms include the renowned MT4 and a variety of third-party tools. The MT4 is available in web, desktop, and mobile versions. Fusion Markets does not have a proprietary trading platform, but this is not a problem given that the MT4 has everything that a trader needs.

This broker has a rating of 4.7/5 on TrustPilot, which is a clear sign that most users are happy with it. Most of those who have reviewed Fusion Markets praise it for low spreads, transparency, and customer service. We have found a few complaints about its tedious verification process.

WHO DOES FUSION MARKETS APPEAL TO?

Fusion Markets is popular with both beginner and experienced traders. Firstly, they do not have a minimum deposit which means that people with extremely low budgets can register and trade. Secondly, Fusion Markets provides a wide range of trading resources to guide new and skilled traders.

On opening an account, new traders are assigned a dedicated account manager to walk with them through the baby steps of trading. Moreover, the broker operates in partnership with companies that offer trading education to provide free and premium beginner courses. These courses are only available to registered users.

Advanced educational materials and courses are also available for experienced traders. Furthermore, this broker facilitates trading competitions to help traders learn from each other. The competitions are open to everyone, including beginner traders who feel that they are up to the challenge. Experienced traders have an option to make an extra income by allowing new traders to copy their trades.

Social-copy trading allows new traders to avoid making costly mistakes and to generate an income as they learn. We will discuss the social-copy trading tools that Fusion Markets provides later in this review.

FUSION MARKETS ACCOUNT TYPES

Fusion Markets provides two types of accounts, namely The Zero Account and The Classic Account. The Zero Account is the most popular with spreads starting from as low as 0 pips and a commission of AUD 4 and below per lot. There is no minimum deposit, and the maximum leverage is 1:500. The ECN account is highly recommended to experienced traders since they must understand how commission sizing works to use it appropriately.

Beginner traders should register with the Classic Account. This account also does not have a minimum deposit and a leverage of up to 1:500. However, unlike the Zero Account, the Classic Account charges spreads instead of commissions. The minimum spread is 0.8 pips.

The two types of accounts also differ in terms of the trading resources provided. Traders who register with the Zero Account get to enjoy a wide range of trading resources and offers than those registered with the Classic Account. However, this is not to mean that new traders should get started with the Zero Account. Traders can always upgrade to the Classic account after getting enough trading education.

Fusion Markets provides a demo account through the MT4. You do not have to deposit to trade with this broker demo account. This broker does not offer an Islamic trading account.

MARKETS AND TERRITORIES COVERED BY FUSION MARKETS

Fusion Markets is an international broker with headquarters in Melbourne Australia, and operations in Europe, Asia, and Africa. The broker was founded in 2010 and boasts of over 100k users today. As mentioned earlier, this broker is not available in the US and other countries where CFDs trading is illegal. These include Iran, Iraq, Ghana, Pakistan, China, Belgium, Japan, and New Zealand.

Fusion Markets customer service, website and platforms are available in English and Thai. This means that it is only accessible to users who are conversant with either of the two languages. Most of their competitors are available in over 15 languages.

It is worth noting that this broker has the largest followership in Australia. However, the fact that ASIC regulates it makes it acceptable in all countries. As mentioned earlier, this regulator is among the most respected across the globe.

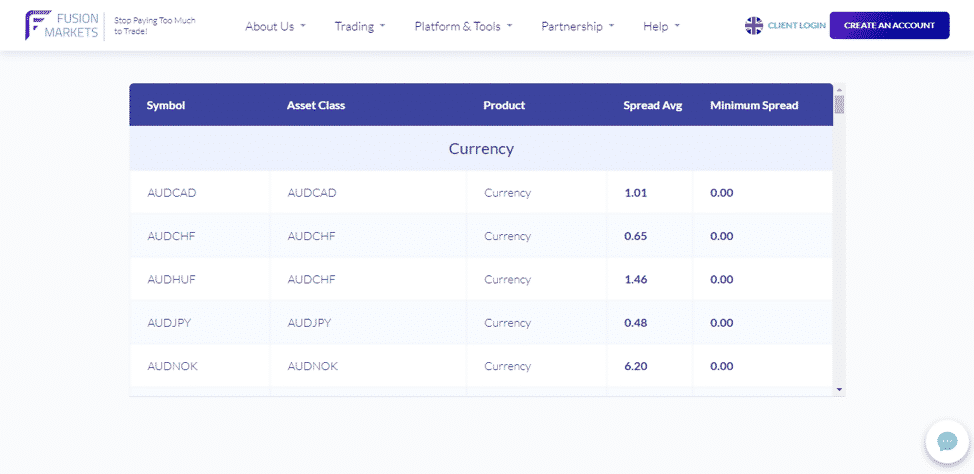

FUSION MARKETS INSTRUMENTS AND SPREADS

Fusion Markets offers forex and CFDs on stocks, indices, commodities, and crypto. Regarding forex, this broker provides over 90 currency pairs, including all the majors and some minors and exotics. The CFDs on commodities include energies such as crude oil and natural gas, precious metals such as gold and silver, and grains such as wheat, cocoa, soybean, and barley.

When it comes to CFDs on stocks, this broker provides exposure to major offerings such as Coca Cola, Google, Facebook, and many more. Indices CFDs includes the likes of S&P 500, DAX 30, DJA, S&P Global 100, and AMX. The crypto CFDs offered by this broker include five pairs that consist of Bitcoin, Ethereum, Dash, and Ripple, paired against each other and fiat currencies.

Fusion Markets is a no-dealing-desk broker (STP+ECN) which means that they charge spreads and commissions depending on the type of account. As earlier, traders who register the Zero account enjoy spreads from as low as zero pips and commissions from as low as AUD 4 per lot. Those who register through the Classic account do not pay any commissions but are charged spreads starting from as low as 0.8 pips.

Fusion Markets claims to be 36% cheaper than its competitors. We can confirm that this broker is among the cheapest that you can find.

FUSION MARKETS FEES AND COMMISSIONS

As mentioned above, Fusion Markets charges a small commission of AUD 4 per lot on the Zero Account. There are no commissions charged on the Classic account, but the spreads for this account are a little bit higher. However, when compared to other brokers, this broker spreads, and commissions remain to be among the lowest.

For instance, the typical spread for the EUR/USD pair when trading through the Classic account is 0.9 pips and 0.5 pips for the Zero account. The average industry spread for the same pair is 1.7 pips. As is expected, a rollover fee may be incurred for positions left open overnight. It is therefore advisable that you close all trades at the end of each trading session.

Non-trading fees are also low when compared to competitors. We have established that Fusion Markets does not charge any deposit or account inactivity fees. Moreover, withdrawals through debit/credit cards and bank transfer are free if within Australia. International bank transfers, on the other hand, come at a fee of AUD 20. This is almost the same amount that is charged by most competitor brokers. The minimum amount that a trader can withdraw through Wire Transfer is $35.

MT4 TRADING PLATFORM AND FUSION MARKETS

Fusion Markets provides the renowned MT4 trading platform. This platform is easy to use for beginners and comes with a variety of features to enhance user experience. As mentioned in the introduction, this platform is available on web, desktop, and mobile. The desktop version is compatible with Windows, Mac, and Linux.

Moreover, this software does not affect the performance of the device it is installed in. The Fusion Markets MT4 is customised to fit their trading conditions and provide a seamless experience to users. It is worth noting that one of the things that make this platform popular is its customisable nature.

As mentioned earlier, Fusion Markets has partnered with third-party trading tools providers to ensure that traders have all they need to trade successfully. Some of these third-party tools providers are free, while others are for sale. For instance, Fusion Markets is in partnership with DupliTrade, a trading tool that enables traders to duplicate the actions of expert traders automatically. This tool is essential for beginner traders looking to minimise the risk of making wrong moves while learning to trade.

The MT4 also provides automated trading through Expert Advisors (EAs). Traders can buy these tools from the markets or pay developers to code their strategies into EAs. Those with basic coding skills can develop their own EAs through the MT4 MQL4 Integrated Development Environment.

FUSION MARKETS MOBILE TRADING

The Fusion Markets MT4 can also be installed in Android, IOS, and Windows smartphones. Traders can download it for free on Google Play Store and App Store. The mobile app is highly intuitive and does not take much space. Moreover, it comes with nearly all the functions that are in the desktop and web version.

The functionalities found in the mobile trader include quotes, charts, trading history, economic calendar live news feed. This review confirms that the demo account is easily accessible through the mobile trader. All that a trader needs to do is to download the MT4, link it to the broker and start trading. The process takes less than three minutes.

FUSION MARKETS SOCIAL-COPY TRADING

Fusion Markets provides social-copy trading through the MT4 and the DupliTrade platform. Social-copy trading involves a beginner trader automatically copying the trades of an experienced trader. This approach to trading helps beginner traders avoid costly mistakes and increase their chances of making a return.

Experienced traders, on the other hand, can make an extra income by selling their trading signals. The Fusion Markets MT4 ranks the signal providers according to performance, with the best coming on top. While some signals are free, others may require a small fee.

DupliTrade is a popular social-copy trading platform that automates the copy trading process. This means that traders do not have to choose and execute signals manually. The platform provides a pool of thoroughly vetted signal providers ranked according to expertise and experience. You need to create an account with DupliTrade and link it to Fusion Markets. The process is secure and should not take more than ten minutes.

This broker social trading tools are similar to what most competitors offer. In other words, they do not have any added advantage.

CRYPTO OFFERINGS WITH FUSION MARKETS

As mentioned previously, Fusion Markets offers crypto CFDs in five pairs. These include Bitcoin, Ethereum, Dash, Litecoin and Ripple paired against each other and fiat money. Crypto CFDs trading with this broker comes at zero commissions and no-requotes.

Crypto CFDs allow traders to bet on crypto volatility without having to own the underlying assets. The high level of volatility witnessed in this industry means that traders can generate huge returns within a short period. With Crypto CFDs, you can apply the short-selling strategy to speculate on both the rising and falling prices. Crypto CFDs are attracting a lot of attention nowadays given the rapidly falling crypto prices.

Fusion Markets provides a leverage of up to 1:500, which means that traders can bet on CFDs worth up to 500 times their capital. Crypto CFDs are risky to trade, and hence traders should approach them with caution.

FUSION MARKETS CHARTING AND TOOLS

Fusion Markets provides multiple charting and drawing tools through the MT4 trading platform. Some of these tools come with the platform while third-party trading software firms provide others. For instance, Fusion Markets is in partnership with TradingView, a web-based charting package and trading social network.

LEARN TRADING WITH FUSION MARKETS

Fusion Markets provides comprehensive guides and well-structured courses covering all levels of trading. Beginner traders can access basic trading education materials immediately after registration. Some materials are accessible before the deposit, but most require users to be fully registered.

The educational materials are available in video tutorials and manuals. Traders can easily navigate through the library to find the materials that suit their trading level. Fusion Markets also partner with third party trading education providers to offer trading courses. Some of these courses are free, but others may require a small fee.

Furthermore, this broker provides regular webinars to update users on the latest market developments. This broker trading resources are scanty when compared to what its competitors offer.

IS FUSION MARKETS A REGULATED BROKER?

Fusion Markets is regulated by the Australian Securities and Investment Commission (ASIC) under license number 226199. For the record, ASIC is one of the oldest regulators in the market. Moreover, it is trusted across the globe due to its stringent regulatory requirements and thorough implementation.

Brokers who are regulated by ASIC must keep their clients’ funds in a segregated account. Furthermore, they must submit periodic reports on deposits usage. This ensures that they cannot use clients’ money for any other purpose other than the intended one.

The regulator also requires brokers to be part of an investor compensation scheme. This guarantees users that their money is protected in the event of broker insolvency. All firms that are regulated by ASIC must hold a valid Australian Financial Services License (AFSL).

When compared to competitor brokers, Fusion Markets is not adequately regulated. Most brokers are regulated in multiple jurisdictions. The best regulators include ASIC, CySEC – Cyprus, FCA – UK, and FSB – South Africa. Even so, Fusion Markets remains a trustworthy broker given that it is fully compliant with ASIC. As mentioned in the introduction, this broker is a brand of Gleneagle Asset Management, a financial company registered in Australia.

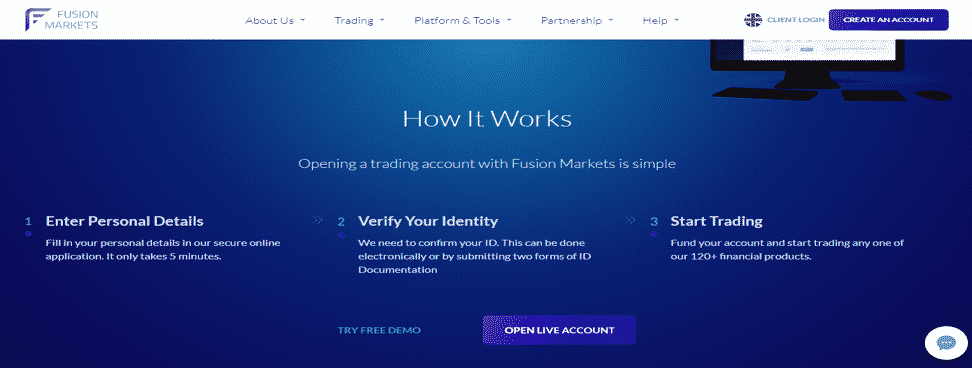

HOW TO OPEN AN ACCOUNT WITH FUSION MARKETS

The account opening process with Fusion Markets is secure and straightforward. Traders must visit their homepage and click the “create an account” button displayed on the header. They are then required to submit their email and create a password. This simple process provides access to their highly intuitive demo account.

Traders must verify their identity through a government ID check and prove their current address by submitting a recent utility bill to continue to the live platform. Financial institutions are nowadays required by regulators to vet their users to weed out money launderers. While most brokers take up to 2 days to verify users, Fusion Markets only takes a few hours.

As mentioned earlier, this broker does not have a minimum deposit requirement. Moreover, it provides two types of accounts, namely the Zero account and the Classic account. Beginner traders should register with the Classic account and only move to the Zero account once they are conversant with how trading commissions work.

Fusion Markets accepts deposits through all major debit and credit cards and Wire Transfer. The accepted currencies include USD, AUD, GBP, JPY, and SDG. As mentioned earlier, this broker does not charge any fees for withdrawals within Australia. International withdrawals, on the other hand, attract a fee of 20 AUD.

CUSTOMER SUPPORT FROM FUSION MARKETS

Fusion Markets provides 24/5 customer support in English and Thai. They are reachable through phone, email, and live chat. You can call them directly or fill the callback request form to be contacted by them.

For urgent communications, we recommend that you use telephone and live chat. Our test shows that they respond to phone calls and live chat almost instantly. Emails, on the other hand, can take up to 12 hours to get a response. We find their agents to be highly knowledgeable and friendly.

FUSION MARKETS REVIEW CONCLUSION

Fusion Markets is a legit broker founded in 2010. This broker provides forex and CFDs on stock, commodities, indices, and crypto and is best known for low trading costs. They offer two types of accounts, namely the Zero account and the Classic account. The Zero Account is best suited for experienced traders. This broker does not have a minimum deposit amount.

FUSION MARKETS FAQS

Is Fusion Markets a regulated broker?

Yes! Fusion Markets is a legit and trustworthy broker. This broker is regulated by the Australian Securities and Investment Commission (ASIC).

How can I open a demo account with Fusion Markets?

The demo opening process with this broker is simple and straight forward. Visit their website and register a free account by clicking the “create account” button.

What are the deposits options for Fusion Markets?

Fusion Markets accepts deposits via Wire Transfer and Visa and Master Card debit cards. This broker does not charge any deposit fees.

How do I withdraw money from Fusion Markets?

Fusion Markets withdrawal methods include Visa and Master Card debit cards and also bank transfer. Traders are required to fill a withdrawal request form for their funds to be processed. It takes up to 24 hours for your funds to reflect in your bank account.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.